TLDR: While Jamie Dimon has nightmares about Satoshi's undo key, Trump's plotting to flip America's financial hegemony into its final form. The play? Turn MicroStrategy's playbook into policy and weaponize Bitcoin. Think Plaza Accord 2.0 meets MAGA meme mania, because nothing screams “America First” like front-running tomorrow’s money with nuclear codes.

Inside this edition

Why Trump's biggest flex isn't TikTok—it's Bitcoin

Uncle Sam's secret life as a crypto whale

How the Art of the Meme could refuel the Empire’s hegemony

Why Michael Saylor's next office might be in the West Wing

THE RENAISSANCE CAPITALIST

ALL THAT’S (UN)FIT TO PRINT IN BIZ & TECH

“More concerned with the timeless than the Times"

YOU’RE HERE BECAUSE:

You build while others build excuses

You, your company, tech, or next big bet is mentioned (or will be)

Your Western values aren't a whisper, but a war cry

You understand that culture needs conductors, not crowds

You spot opportunities like Nancy Pelosi spots a great trade

And while God gifted me with talent, she forgot the humility module.

Binary identity revealed below.

(Pronouns were harmed in the making of this newsletter.)

Most up-to-date version with 90% less typos at renaissancecapitalist.beehiiv.com

A (Trump) Coin Flip

The press room is buzzing: “Mr. President, would you let Elon buy TikTok?”

Trump smirks—he’s weathered tougher questions from Melania about Stormy.

Of course he would.

Then he flips the coin to the nearest billionaire in the room.

"I'd like Larry [Ellison] to buy it, too."

Then Trump floats an idea that would make Elizabeth Warren’s malware implode.

“...buy TikTok, and give half to the United States of America,’”

Trump declares from the White House podium.

“And we’ll give you the permit.”

A nationalization commission. Proposed to Larry Ellison. Live on TV.

Just another Tuesday in America, where the Overton Window has become a tiny, shattered window pane at Mar-a-Lago.

If Trump can propose a nationalization commission for a TikTok sale with the confidence of a ClosedAI hallucination, imagine what follows when El Jefe sets his sights on something bigger: annexing (more of) the blockchain.

What you’re about to read is a fever dream of how the man who turned “You’re fired” into foreign policy might just flip America’s monetary destiny—and how a Bitcoin reserve Uncle Sam already owns (you read that right) could help shape his next (very) foreign policy.

Making America Stack Again

Most fiat currencies in history share the same obituary: born through crisis, corrupted by power, killed by hubris. The U.S. dollar's story started no differently, and its ending might rhyme.

In 1944, while Europe smoldered and Asia rebuilt, America emerged with something unprecedented: half the world’s productive capacity and a treasury stacked with gold. At the Bretton Woods conference, 44 nations met to decide the new global order’s financial operating system.

But it was less a conference and more a coronation.

They came to acknowledge what Uncle Sam had already decided: the U.S. dollar wasn’t just currency; it was the gravity of global trade. The U.S. dollar would be pegged to Gold, and other currencies pegged to the dollar (before eventually getting the other type of pegged).

But by 1971, the crown was getting heavy. New gravitational forces emerged as Europe and Japan rose from the ashes, leaving America with a choice: share power or change the rules. President Nixon, refusing to yield the throne, chose the latter and ended the dollar’s convertibility to gold (“the Nixon Shock”).

America got all the sugar highs of money printing without the diabetes—exporting the calories to countries holding the dollars they printed instead. The ultimate financial gastric bypass in a pre-semaglutide world.

A geopolitical rug pull that made Trump's meme coin look like Aladdin listing his carpet as a fractional timeshare NFT. And speaking of Aladdin, he’s currently in ICE detention learning that "A Whole New World" doesn't qualify as a travel visa.

Treasury Secretary John Connally said it best:

“The dollar is our currency,

but your problem.”

Which was code for:

“We keep the benefits of reserve currency status, and you get the bill.”

If that sounds like the original white privilege, I wouldn’t know—I don’t even see color.

A Hegemony that’s all He(d)ge, no Mon(e)y

Fast forward to 2025:

The U.S. commands 15% of global GDP but somehow still wields 57% of global reserves. That 42% spread—the "hegemon premium"—is where America's political power exceeds its economic weight: a gap between what foreign nations need to hold in dollars versus what U.S. trade actually justifies.

Like maintaining an iron grip on the global financial stack through minority ownership and legacy founder-class voting rights, while others build their GDP on top.

For every other nation, it’s closer to:

A financial Hotel California: you can check out any time you like, but Treasury never lets you leave; or

A financial timeshare where exit fees are measured in regime change.

But every empire has its sunset.

Just as Rome’s denarius crumbled from 95% silver to worthless bronze, fiat currencies follow a familiar death spiral: the backing vanishes, money prints, trust dies, and alternatives emerge.

Sound familiar?

No empire can outrun scarcity forever. Troops are already lining up on multiple fronts to dethrone the greenback (at least in its unhinged, fiat form).

But there might be one last plot twist.

The Death of Old Money

Gold rode the USD's coattails like Kim K rode RayParis Hilton's, and less so when Nixon exchanged that peg for one far less consensual—and Treasury Secretary Connally said the quiet part out loud.

For decades afterward, the world bought what America was selling. Post–Cold War prosperity and U.S. economic strength made gold’s “safe haven” status feel obsolete. The dollar’s dominance once again seemed unshakeable.

The USD wasn’t just sound money; it was the sound of money.

But something changed around 2005. Central banks started hoarding gold like NYC neurotics stacking canned sardines during COVID.

Every financial crisis, every money-printing spree, every near-zero interest rate experiment pushed them further from dollars that smelled increasingly like arrogant old money—and closer to the periodic table.

But what if they backed the wrong horse?

Or, said differently: what if the race could be rigged? Enter Bitcoin.

The Death of Old(er) Money

Instead of debating the eventual flippening of gold by Bitcoin, let’s cut to the scoreboard:

Ten years ago, Bitcoin barely registered at 0.14% of gold’s market cap.

By last December? 14%.

That’s a 100x leap… in a decade.

Bitcoin as % of Gold’s market cap

Even as gold fights its midlife crisis with TV infomercials, it’s as relevant with new money as open source is to Sam Altman’s position on the Forbes list.

Here’s the real plot twist: Parts of the institutional flippening have already happened.

Despite gold’s 20-year head start on magic internet money, gold just got leapfrogged by Bitcoin ETFs in assets under management (AUM).

Yet Jamie Dimon was still J.P. Morgan-splaining how Satoshi could return and “Ctrl + Z” Bitcoin into oblivion to the press only this week.

Fintech side bar

If you want to spot the white space that remains for fintech…

Go chat with any banking exec about their ‘digital transformation’ — which is generally a $2 million PowerPoint riddled with buzzwords a McKinsey MBA picked up at the same Gartner conference he contracted chlamydia at in Dallas.

Corporate innovation is really what happens when suits mistake corporate offsite bingo for strategy….

If you’re enjoying this post or know someone who may find it useful, please share it and encourage them to subscribe here.

Uncle Sam’s Piggy Sats

Some debate whether a Bitcoin reserve will ever exist.

Spoiler alert: it’s already here.

The U.S. government is already the largest government holder of Bitcoin.

Is it officially labeled strategic? No.

But poke around federal websites for “DEI” if you really want to gauge this administration’s obsession with labels.

And when it comes to government Bitcoin stashes, we’re—like Joe Rogan insisting on UFOs every chance he gets—definitely not alone.

From China to Ukraine, governments have seized Bitcoin—and most have kept it.

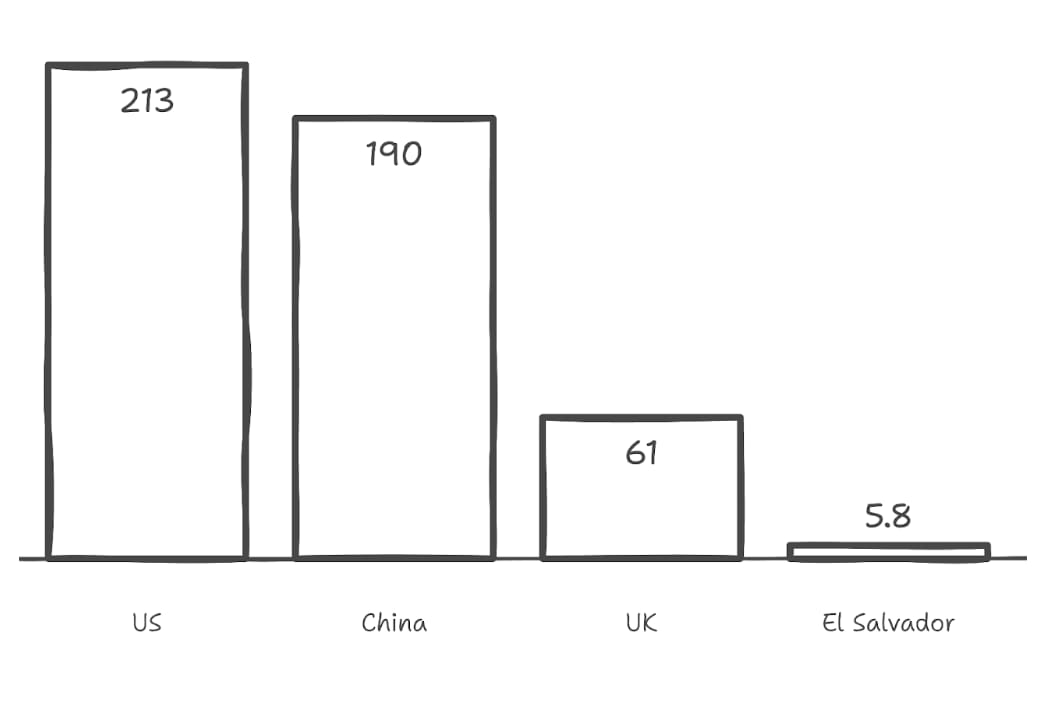

Major Government Bitcoin Holdings (thou)

The odd one out? Hitler’s heirs.

Germany, true to form, chose rigid policy (and perhaps virtue signaling) over value storage. It sold its seized Bitcoin in 2022 with the same foresight (read: regret) that led it to shutter its nuclear plants—the safest (by death rate) and cleanest reliable energy it had.

By the time Russian tanks rolled into Ukraine, that disastrous decision left Berlin begging Moscow for a third of its oil, half its coal, and most of its gas.

German masochism runs deep.

But any seized Bitcoin is just the starting position.

Sure, most leaders might consider optimizing pricing on their first block of a long-term, multi-decade accumulation of reserves as missing the forest for the trees. Trump, however, doesn’t see the forests or the trees, just a stack of sats that could etch his name into history.

If the same guy who tweets about annexing entire nations wants more Bitcoin, he’s not even paying retail—especially if he thinks he’s the rocket fuel behind its next leg up.

Less “quiet accumulation,” more “stealth-to-hostile takeover of tomorrow’s money.”

Tipping the Flippening

Most presidents would gather committees, secure approvals, and gently tiptoe into new reserve assets—without worrying about hedge funds front-running their trades.

Trump, however, is not most presidents.

More importantly, he doesn’t get front-run; he runs in front.

Once it goes public, expect the signature Trump flourish—maybe “Trump Bonds” that spice up Treasuries with a Bitcoin kicker.

If that sounds like MicroStrategy's playbook, trust your private keys.

Before we break down a “realistic” (pre-inauguration, pre–meme coin rug) MicroStrategy-style reserve build, let’s indulge the most outlandish, reality-TV-worthy scenarios—like a pay-per-view exclusive on Truth Social.

Picture the opening scene: Trump on his cross-trainer at 10 AM, scrolling meme coins while blasting 50 Cent's "Don't Push Me," before calling Panama's President about renaming rights to the "Trump Canal."

The Art of the Meme

We could debate whether a Bitcoin reserve serves America, the Empire (or as Joe Lonsdale popularizes, “the Republic”), or America’s citizens.

But Trump’s calculus is simpler: what serves Trump?

Having launched $TRUMP days before inauguration, his net worth now rides on crypto markets. Overnight, the same man who turned "Trump Steaks" into presidential policy had a majority of his wealth flip into a memecoin that makes Solana look like T-bills—even if only temporarily.

Within a week, the value of his stake in the project (as stable as his last term’s cabinet retention rate) would be $28 billion—against a WSJ estimate of his pre-sh*tcoin net worth at $7.5 billion (others say $2.5 billion, but let’s use the number he wants us to).

So when President Trump announces any American Bitcoin reserve, he’s not just propping up U.S. hegemony—he’s engineering a generational wealth transfer to a family more focused on sh*tcoin charts than Hunter Biden’s laptop contents. (On second thought, the Trump family's “Hunter files” probably rival their tax returns for storage).

It’s the ultimate monetization play: turning presidential proclamations and Mar-a-Lago into a tribal casino where the house always wins (and always tweets)—an opt-in state lottery funding MAGA’s ambitions, once they become articulated.

Until then? Mar-a-Lago upgrades.

The (Trump) Plaza Accord

The original Plaza Accord was Washington’s masterstroke to keep Japan in check.

Trump’s spin? Turn that same tactic against (a very select few of) his own.

Enter Michael Saylor, who gets the call:

“Michael, we’re gonna do something beautiful. The most beautiful Bitcoin trade ever.”

The play?

Make MicroStrategy the government’s stealth prime broker—not just for its infrastructure and OTC relationships, but for something more… creative (Latin for “potentially illegal”).

Saylor speed-dials ten OTC desks, each with the same script:

“You’re my first and only call—five billion dollars in Bitcoin.

You have ten minutes before I move on.”

Each desk scrambles, blinded by a greed-induced hallucination they’ve got an exclusive.

The trap?

When desks realize that the $5 billion order they’ve just underpriced is really $50 billion, they face delivery or default.

What starts as a massive yet routine OTC trade morphs into a “long squeeze” that makes GameStop look like a garage sale. It would be the last call they ever take from Saylor.

Either way, they’re bound by the (Trump) Plaza Accord.

By then, the fill price is locked, desks are in chaos, and America’s Bitcoin stash swells by $50 billion—at last week’s prices—no press release required.

MicroStrategy’s incentive? Beyond a potential commission, validation when government disclosure sends Bitcoin vertical.

And sure, the SEC demands disclosure, but trades can outrun regulators—just ask Elon.

The New(er) Deal

That sounds crazy, but it makes for good TV. Whether it’s a version of reality TV, we’ll see. But the point is: it could get crazy before it gets even crazier.

Picture Trump demanding every Bitcoin holder—companies, exchanges, endowments, ETFs, and individuals—fork over 10% of their BTC at a “fixed” rate, maybe even sweetening the pot with a small premium if his blood sugar levels are stable.

Overnight, the U.S. government becomes the biggest red-white-and-blue whale in Bitcoin.

Sure, it sounds far-fetched… except America has already done a version of this before.

In 1933, Franklin D. Roosevelt confiscated private citizens’ gold in a similar way through Executive Order 6102.

Why? To stop Depression-era gold hoarding.

Hoarding that handcuffed the government’s ability to print money (shocker, I know).

Was it legal? Sure.

The Supreme Court rubber-stamped it faster than a Trump University diploma, though constitutional scholars still grumble about it today.

If Uncle Sam once seized everyone’s gold for the “greater good,” don’t rule out a 21st-century encore with Bitcoin—to bolster U.S. hegemony (and pad Trump’s bags).

Different crisis, but a potentially similar playbook.

The Ouroboros

Transfers of power are rarely polite.

From Thucydides Trap between Athens and Sparta to Thucydides's VariantTM starring COVID and TikTok. From the Spanish Inquisition’s gold hunts (theft) to Executive Orders that fixed the price to buy back American gold (theft?).

“The greater good” for a sovereign seizing or maintaining power can justify an unexpected iron peg.

History doesn’t repeat, but it does tweet. As America’s financial empire faces its own golden sunset, Bitcoin might just be part of the plot twist that keeps the U.S. dollar relevant—even if it means Trump has to grab the periodic table by the privates.

Think of it as a White House Ouroboros: a snake devouring its own tail, and not just about shedding fiat skin for cryptographic ones. If you find even the idea insane altogether, remember:

The next chapter of the U.S. dollar won’t be penned by economists or politicians, but by a reality-TV star with nuclear codes and laser eyes.

Trump Yourself,

Daniel

If you enjoyed this post or know someone who may find it useful, please share it and encourage them to subscribe here or at https://renaissancecapitalist.beehiiv.com/

WHO IS THE RENAISSANCE CAPITALIST?

Part adventure capitalist, part librarian — Daniel Attia is a (venture) investor & builder who writes in the third person and backs founders reinventing reality through preemptive.

(portfolio below)

His lens comes from a random sprint through high finance, startups, tech & media, venture, hedge funds, and the arts.

He mastered capitalism's grammar at Deutsche Bank and Goldman Sachs before being force fed its real-life principles as the first US hire at Payapps (acquired by Autodesk for ~$500M).

Daniel would later shape tech and market perspectives as founding Head of Research at Prof G Media, contributing to works like the NYT Bestseller "Adrift: America in 100 Charts."

His favorite capitalist pastime may be steering companies away from entropy toward rationalism (often mislabeled as "shareholder activism"), partnering with hedge funds, families, and shareholders who've grown weary of watching their capital fund executive delusions.

Today, he serves on the Foundation Council at the State Library of Victoria—the world's third busiest library—while moonlighting as consigliere to founders and CEOs at pivotal crossroads.

Daniel also serves as Special Advisor to VP Capital, a HK based hedge fund.

Daniel co-founded Pew Pew NYC, a non-profit art collective for the creatively curious

(which just unveiled Call me Lola in Mexico City, the first live-in art gallery hotel experience where 70% of art sales flow directly to artists!)

Select venture investments:

beehiiv (this very platform) – Because Tyler Denk always had Big Desk Energy

SymphonyOS – beehiiv for artists (Business Insider Top 13 Creator Startups to Watch, just like beehiiv. Led seed alongside Tyler too)

Harmonic Discovery – Precision pharmacology (JP Morgan Life Sciences Award winner)

Carry – Putting tax optimization on autopilot, built by Ankur Nagpal who turned his $250M exit lessons at 32 into your tax solution

Measured – Medicine minus middlemen led by dreamer and DREAMer immigrant Monji Dolon (seed with Initialized Capital)

True3d — Building livestreaming infrastructure for 3D by Meta livestreaming veteran Daniel Habib (still can’t believe we got an investor mention alongside YC founder Paul Graham)

EatBlueprint by Jeff Tang (now merged with Bryan Johnson’s Blueprint)

Atelier – Making manufacturing magnificent again (Co-led Series A with Macquarie Capital, confirmed by the AFR paywall preview)

/