TLDR: Forget TikTok acquisition rumors – Elon doesn't need TikTok's digital fentanyl to make X the most valuable company on Earth. The blue bird was just the beginning. The real story? How Tesla, Starlink, and xAI fuel X's ascent into an empire that makes today's trillion-dollar tech look like legacy software.

Inside this edition

How Musk's corporate Transformers assemble into something worth more than the sum of their parts

Why Tesla, SpaceX, and xAI aren't just separate companies, but modules of the first corporate network state

The real reason Musk moved to Texas (hint: it's not just the taxes)

Why a16z flipping Goldman in DC marks the start of Silicon flipping Botox

How Starlink turns traditional telcos into the next Detroit

Why SuperX could make Saudi Aramco look like a corner bodega

Most up-to-date version with 90% less typos at renaissancecapitalist.beehiiv.com.

THE RENAISSANCE CAPITALIST

ALL THAT’S (UN)FIT TO PRINT IN BIZ & TECH

“More concerned with the timeless than the Times"

YOU’RE HERE BECAUSE:

You build while others build excuses

You, your company, tech, or next big bet is mentioned (or will be)

Your Western values aren't a whisper, but a war cry

You understand that culture needs conductors, not crowds

You spot opportunities like Nancy Pelosi spots a great trade

And while God gifted me with talent, she forgot the humility module.

Binary identity revealed below.

(Pronouns were harmed in the making of this newsletter.)

LET THAT SINK IN

Saturday night. My loft's overrun by 12 artists gearing up for Pew Pew Miami.

An aerialist rummages through silks on the floor.

A contortionist attempts an upside-down split from within a Zorb ball floating in the pool.

Upstairs, models are being painted head-to-toe in metallic bronze and gold like extras from Goldfinger's fever dream, and there's enough paint fumes in the air to make even Charlie Sheen high.

The whole place looks like Cirque du Soleil's R&D lab had a wild one-night stand with Studio 54 (Steve Aoki’s words, and mine).

Amid this glittering chaos, my phone rings – Scott Galloway.

He asks if I’m at my place in New York, somehow shocked I’ve moved to Miami—even though I hitched rides on his jet from West Palm to Teterboro near weekly. Bless him.

Twenty minutes later, a text with a Zoom link. No context.

Twenty seconds later, a Zoom mosaic of private equity and hedge fund titans.

The conversation? Twitter.

Specifically, a takeover of it.

"Daniel, walk them through your research and the math."

For years, Scott and I had been mapping Twitter's bloated cost structure like forensic accountants at a crime scene.

His public letter to the Twitter board wasn't just another Prof G rant – it was an indictment that caught Elliott Management’s eye. They called months later, having signed that manifesto with a $1 billion stake.

But hedge fund activism couldn’t reform a ‘body positivity’ cult that celebrated its need for corporate GLP-1 antagonists while making DEI its bottom (and only) line.

DEI ANOTHER DAY

Years of watching real money move taught me something Buffett knew well:

"Some deals are very simple. If you don't know enough to make a decision without checking more, you probably shouldn't be doing the deal in the first place."

— Warren Buffett (Berkshire Hathaway)

And unlike day-trader VCs drunk driving into the 160th bed-in-a-box startup with a promise to elevate consciousness, private equity and hedge funds prefer short, sharp, violent changes to "unlock value" without conscience.

Their favorite act?

Liposuction.

And Twitter was ripe for the knife.

Twitter's shadow DEI ministry was recklessly laundering its narcissism through pet pronoun projects disguised as R&D spend.

Once critiqued at $800m in 2020, they raised the stakes and were running towards an annualized spend of $1.5bn.

Two years and $2bn later, all we got was Spaces and the aptly named Fleets, which launched and died faster than FTX’s compliance department.

But shipping more pronoun protocols than git commits had its perks.

The prize for winning Olympic gold in product stillbirths?

Nearly two-thirds of all stock compensation.

Failure hadn’t been so well rewarded since Adam Neumann left his DNA all over Masa Son’s mouth.

FLIPPING THE BIRD

These Gordon Gekkos didn't need EBITDA gymnastics – just the stomach to rightsize a wokeforce turning a public company into a kindergarten with a ticker symbol.

“Before we move on to timing—safe to assume it’s just us in the sandbox? Any other real bidders?”

"Elon Musk."

Excel jockeys snicker like I suggested Tom from MySpace was launching a SPAC with Dorsey’s meditation budget.

I point out Musk is itching to birth his 'X' vision and offload some overpriced Tesla shares with a narrative that keeps the Elonstans in their prayer circles (i.e. doesn't tank the price).

Two weeks later, Elon reveals a 9.2% stake.

Fast-forward, and Twitter’s hostile makeover didn’t just upend media or politics; it became the missing puzzle piece in Musk’s master plan—one that redefines corporate sovereignty, transcending borders and big-tech valuations alike.

BILLIONAIRES WITHOUT BORDERS

Apple, Microsoft, and Saudi Aramco sit atop their trillion-dollar pedestals like permanent constellations in our capitalist cosmos. But markets move like mercury in summer, and value can vaporize—and materialize—at the speed of tweets.

Largest 8 Companies by Market Cap (Jan 2025)

Like my Hinge algorithm after a week in Miami, the market's become increasingly top-heavy (though maybe I'm projecting).

The top 10 stocks in the S&P 500 are now 800× larger than the 75th-percentile stock – surpassing even Great Depression-era levels.

The index is 50% more concentrated than in 2001 — making even basement-dwelling incels’ meme accounts look diversified.

If you'd think this makes them untouchable, check that Star Island energy — even Diddy had to downsize.

Youth has a way of disrupting dynasty. When IBM was the baby-faced titan at 53 in 1964, no one saw Microsoft coming. Now Microsoft's the greybeard at 50, barely older than Apple's 49. Meta's barely legal at 20, neck-and-neck with….

Tesla, a company that survived more near-death experiences than the British pound, now commands more market cap than the next 10 largest automakers combined.

David vs. Ten Goliaths: Tesla's Market Cap Dominance (Jan 2025)

The lesson?

Market dominance isn't about age or size—it's about adaptation speed.

And the one industry that’s turned stagnation into an art form?

Telcos.

Where ‘innovation’ means: discovering new ways to charge your grandmother's estate for services she never understood (in this life or the next), paying Goldman millions to play infrastructure musical chairs, and deodorant remains an optional add-on to fossilized customer service (pending regulatory approval).

Telcos Meet Their Meteor

Tesla proved how a tech company masquerading as a carmaker could turn century-old auto dynasties into Detroit museum pieces. This time, it's not just Telcos getting Tesla’d.

Musk is plotting something bigger: using Starlink to build a sovereign infrastructure that helps Musk make X the most valuable company on (and off) Earth.

Traditional telcos are prisoners of geography – trapped by massive infrastructure costs, protected only by regulatory moats, and chained to two-decade ROI cycles. But every Starlink launch is another extinction-level event for these dinosaurs, soon to discover that regulatory capture can’t stop a meteor shower.

Space Oddity

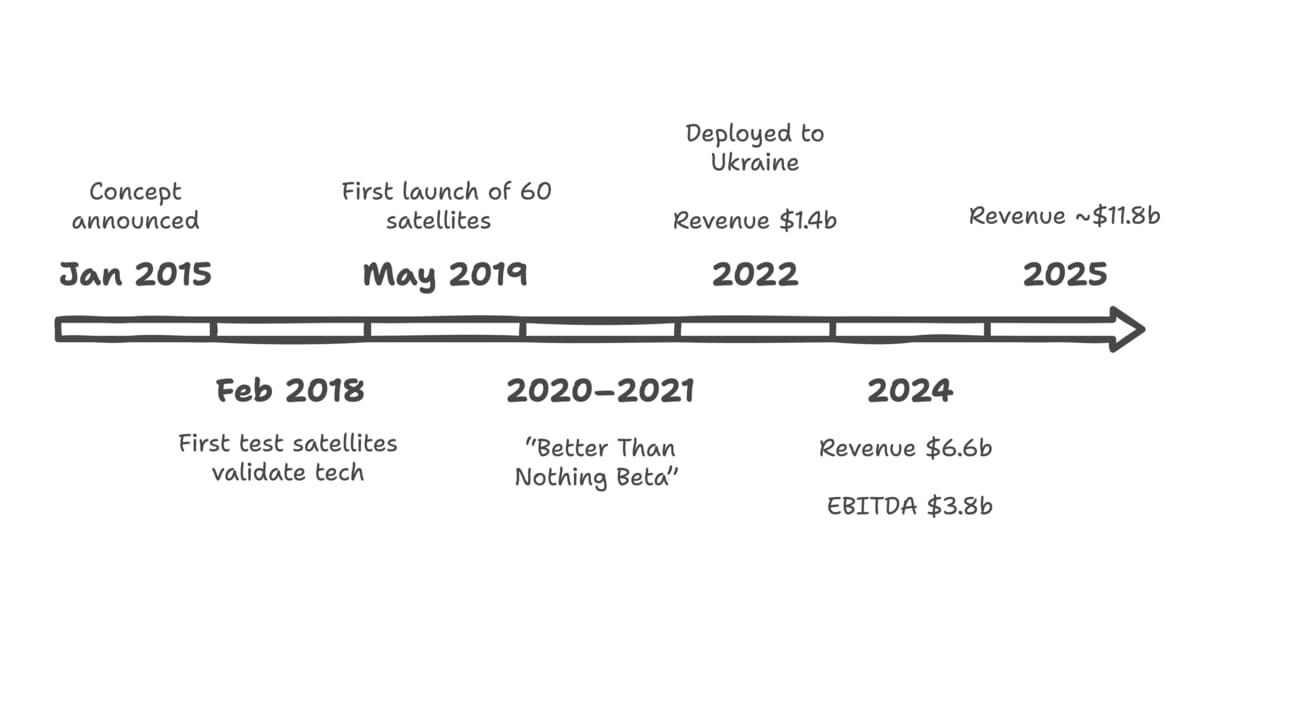

In 2015, Elon first floated the idea of “rebuilding the internet in space.” Four years later, Starlink launched its first 60 satellites in 2019, followed by a “Better Than Nothing Beta” rollout that attracted early adopters over the next two years.

Then in 2022, Starlink’s emergency units arrived in Ukraine free of charge—yet the company still recorded $1.4 billion in revenue. By 2023, Starlink surpassed $6 billion and breakeven. This year, it’s forecasted to nearly double that figure at $12 billion.

Launch Sequence – Starlink milestones

Sources: The Information, Payload, Public Filings, Broker Research

The numbers might seem modest at first, but the trajectory is (literally) out of this world. But numbers are just the launch pad.

The real payload deploys when these pieces align, forcing regulators to rewrite their playbook as vertical integration breaks the Kármán line.

Just like Tesla reinvented manufacturing from first principles, letting bits tell atoms how to vertically integrate, Starlink is doing the same to connectivity.

But neither Tesla nor Starlink stand alone.

What look like separate companies—cars, satellites, social media, AI—are really layers of Musk’s expanding empire, each amplifying the next.

Musk’s Hierarchy of (Superapp) Needs

At the foundation, Tesla adheres to its core principles and transforms bits into atoms.

Above it, Starlink claims the sovereign sky, weaving a constellation of satellites into infrastructure that make national borders less important than network sovereignty – a term we’re going to hear a lot more of in big tech.

Then comes X, where attention meets intention, turning every scroll into a potential transaction.

At the command center, xAI serves as the neural network, optimizing everything from content delivery to commerce flows.

Less vertical integration, more vertical sovereignty.

Sensing a theme yet?

This isn't just about internet access. It's about sovereign infrastructure for global commerce.

While every other would-be superapp has to build on top of local telcos, X will own its entire stack: Tesla handling logistics, ridesharing, manufacturing, and ground stations, SpaceX launching satellites, Starlink providing connectivity, X as the interface, and xAI optimizing it all.

The real kicker?

When your delivery infrastructure (Tesla's autonomous fleet) runs on your connectivity layer (Starlink) and your everything-app spine (X), you’re not just giving Bezos fresh excuses to fire Blue Origin’s phallic fantasies into space — you’re building a network state where sovereignty is measured in terabytes, not territories.

And what might that entity be branded? SuperX.

If you’re enjoying this post or know someone who may find it useful, please share it and encourage them to subscribe here.

Interest rates are the gravity of markets—unless you're Elon, who builds empires (and narratives) big enough to bend valuations, space-time, and even the SEC to his will.

But this time, it’s not just valuation and the SEC he’s achieving escape velocity from.

X is evolving into more than just another trillion-dollar juggernaut. It’s evolving into the operating system of a new type of digital empire.

One where the blue bird’s carcass is just the front-end for something bigger: SuperX.

Less social network, more sovereign network (more below).

Not Your Drone Manufacturer’s Superapp

WeChat proved superapps work in Asia, leaving the Western market as digital Greenland—vast, unconquered, and ripe for annexation.

But SuperX transcends the clichéd ‘WeChat of the West’ ambition into something that makes WeChat look like a messaging app.

While Zuck bets the macadamia farm on pulling forward VR & AR (bullish) and ByteDance performs its digital fentanyl defense in Washington (bullsh*t), X is quietly building the rails for sovereign commerce.

X.com was born from Musk's original superapp vision while Zuck was just learning empire building on Civilization VI in middle school. But, lacking capital, Musk was forced to merge with Thiel's Confinity (later PayPal) rather than compete. Platform dependency then forced a sale to eBay to avoid extinction.

PayPal still became a ~$100b payments giant.

Musk now returns with everything his first attempt lacked: billions in capital, global distribution, and an arsenal of corporate Transformers ready not just to assemble and reclaim that territory, but to annex entire digital continents.

Annexing Green(er)land

X isn't just occupying Twitter's former territory—it's methodically entering market segments with pre-ZIRP startup precision. But like TikTok before it, X isn't just what it appears to be.

Take video.

While Netflix was busy winning yesterday's streaming wars, TikTok was winning tomorrow's attention wars.

What looked like social media was something far darker: an AI juggernaut that doubled as the most sophisticated propaganda tool ever devised, with closer proximity to the CCP than Hunter Biden to his dealer (see, true love does exist).

Even as regulatory scrutiny over Beijing's algorithmic trojan horse pushed some advantages to YouTube, TikTok had already revealed the playbook: AI-driven content recommendation wasn't just an engagement tool—it was replacing social graphs with interest graphs, making Facebook's 'connecting people' mantra look like Web 2.0 nostalgia.

Enter X and its xAI brain trust.

While other tech darlings are debating Zuck’s eviction of tampons in men’s bathrooms, Musk is architecting something more lethal: an operating system where network effects compound across orbital and terrestrial infrastructure.

Yes, amputating Twitter’s wokeforce enables better creator economics.

And yes, when questions like “what did you get done this week” replace “what color purple is that hair dye?”, the newly found product velocity creates a predictable flywheel: more users, more creators, more content, more data, more surveillance etc.

But that misses the ketamine from the caffeine.

The real alchemy isn’t in the flywheel of one Musk Transformer, but in the network effects between them all.

Imagine a sovereign stack where Starlink’s infrastructure utilization drives X’s user growth, while xAI converts that engagement into intelligence for everything from ad personalization to autonomous routing. Tesla’s fleet delivers the commerce while getting smarter with each mile—enabling competitive rideshare economics that onboard millions more into X’s ecosystem.

This isn’t just platform expansion—it’s economic annexation through technical superiority and sovereignty.

Every territory X claims—from payments to video to commerce—isn’t just another feature set. It’s another node in an emerging network state where digital borders Trump geographic ones.

Transformers

Big tech build monoliths, Musk builds Transformers.

SuperX fuses these Transformers—X, Tesla, Starlink, xAI—into an empire that behaves less like separate apps and more like modules of a sovereign digital nation.

In other words, exactly what Balaji - the other guy with a brain the size of a small planet - defines as a Network State (just add an Empire) in his brilliant book by the same name.

Before getting to Balaji’s definition, some context on the Polymath (Protocol) Prophet from Tim Ferriss:

"Balaji tends to see around corners and make predictions that might sound wildly speculative — until they eventually come true"

Those predictions included being the first person to see COVID coming a Wuhan mile away.

Side bar

While advising on a multi-billion dollar hostile takeover, I walked away from the role (and fees) after Balaji's COVID warnings.

The target's stock got cut in half — and we would've been forced buyers at the pre-crash price plus a premium if we'd listened to the bankers.

Having gone from ultra dismissive of this idea to seeing its potential up close at Balaji's Network School (think Y Combinator meets Bryan Johnson's Blueprint) it's a definition worth thinking through:

A Network State is a highly aligned online community with a capacity for collective action that crowdfunds territory around the world and eventually gains diplomatic recognition from pre-existing states.

Final (M&A) side bar:

“Not my purse” - Jeff

Now back to regular programming, where Musk might just turn this theory into trillion-dollar practice…

Martian Assembly

By bridging mobility, connectivity, finance, and intelligence under one roof—with moats that transcend orbit—SuperX isn’t just shaping up to be the world’s most valuable company; it’s shaping up to potentially be the largest corporate network state on (and off) Earth.

SpaceX, Tesla, X, xAI: not just separate entities in Musk's construction kit, but a modular empire waiting to assemble into something bigger.

While Sam Altman flipped OpenAI from open-source saint to closed-source sinner faster than Gollum betrayed Frodo (pocketing Elon’s $44m charity en route), Musk is plotting something far more ambitious: reinventing corporate structure altogether.

The genius?

By keeping them technically separate, Musk sidesteps 20th-century monopoly definitions.

Said differently, instead of tweeting “FUNDING SECURED,” he waits for the perfect moment to snap them together, evading regulators in the meantime.

Annunaki Feces

Elon’s Annunaki feces (alien sh*t) disguised as corporate layers don’t merely chase Earth’s highest valuation; they’re part of a narrative that’s redefining humanity’s next frontier.

Through a blend of regulatory aikido and corporate arbitrage that would make Microsoft's antitrust lawyers blush (see: OpenAI playbook), these nodes of Musk's sovereign network can siphon services (and value) into its command center, SuperX.

Picture NVIDIA's chips becoming the neural network for this corporate organism: powering xAI's models, running on X's platform, beamed through Starlink’s orbital web – all while antitrust watchdogs are left scrolling Bluesky.

Take Starlink: not just a SpaceX spinoff, but a telecom trojan horse driving X subscriptions globally.

The numbers speak to that potential: 3x traffic growth globally in 2024, with emerging markets like Georgia and Paraguay seeing 100x and 900x spikes, respectively.

Tesla follows the same playbook: not just an EV maker but a sleeping rideshare giant whose hardware & robotics could leverage X's flywheel to design and deliver consumer products globally at zero advertising cost – creating distribution channels that make Amazon look like a local delivery service.

Then there’s xAI—the brain of the operation—potentially operating through “service agreements and partnerships” that deliver the sweet taste of a merger (exclusivity + earnings) without the calories (antitrust, investment banks, and lawyers that couldn’t close a door in a brothel).

Combining these powerhouses would make Saudi Aramco look like a corner bodega. And fittingly, the place it’s shaping up to happen in? Texas.

These aren’t mere corporate combos—they’re modular parts of a Texas titan, (where they’re eventually listed).

But once the stars align—valuation, vision, and velvet-glove regulatory timing—he’ll snap them into a force no single watchdog can contain.

And once you own the digital rails, controlling the physical territory is the next frontier.

Silicon > Botox

Musk hasn't just flipped Silicon Valley red – he's dragged Washington's center of gravity westward in the process.

While California's politicians - playfully called "leaders" - realize they can't put out wildfires by waving the flag of Wokistan and chanting progressive platitudes, watching the world's 5th largest economy dissolve into a dystopian soup of performative politics and chargrilled shorelines, Texas is becoming tech's landing pad.

It started with Musk's 2020 exodus, and the dominoes haven't stopped falling. The institutions of cultural transmission—media, tech, and capital—now follow him like hedge funds chase Pelosi's trades.

Watch as a16z replaces Goldman at the White House, and Anduril and Palantir replace Lockheed and Halliburton at the Pentagon.

Sure, some tech elite cling to San Francisco's hellscape—rearranging Titanic's deck chairs while the ship burns and the DEI board takes attendance.

Ready. Set. Starbase.

But Musk isn't just relocating—he's colonizing.

Along Texas's Gulf Coast, SpaceX is beta-testing more than catching rockets with chopsticks. They're prototyping governance itself with Starbase, a would-be municipality where 3,400 employees and contractors are about to trade municipal red tape for Martian ambitions.

It’s Musk’s testing ground for corporate sovereignty… which is exactly what you'd expect when someone who builds interplanetary transport gets tired of terrestrial bureaucracy.

SuperSize M(e)usk

But the real prize in this western conquest?

A Texas stock exchange that supersizes everything—especially Musk’s influence.

Not just another trading venue, but a purpose-built platform where Tesla, SpaceX, and X play by Dallas rules, not Delaware’s. Critics cry regulatory arbitrage; Musk calls it survival instinct: why let your enemies (continue to) referee the game?

And X isn’t just amplifying this shift – it’s become the megaphone of this new order.

Every nation-annexing tweet, every interview too spicy for the Midget Mainstream Media™, flows through pipes leading back to Texas—where the sun powers more than Musk’s gigafactories; it fuels his sovereign network state.

This modular empire is also attracting kingmakers hungry for their next moonshot.

The Blind Fund’s Redemption

SoftBank's Masa Son, who is now wearing Trump's DNA all over his mouth from that $100bn investment commitment, knows a corporate evolution when he sees one – and this might be Masa’s next moonshot.

Jokes aside:

Masa Son's missteps overshadow his pioneering contributions to tech.

He's an embodiment of all that's right with America – optimism, entrepreneurship, cooperation, risk-taking, immigration.

Yet gets vilified for being a patsy to all that's wrong with America:

a culture of narcissism and celebration of wealth that drowns out all competing values, personified in

Adam Neumann.

Masa spotted NVIDIA’s potential in 2017 with a $4bn stake, only to bail in 2019 and leave over $150b on the table. He even kicked the tires on Tesla in 2017, flirting with taking it private, then walked away before Musk silenced the doubters.

Now, with X and xAI converging into a capital-heavy, epoch-shifting empire, Masa senses another shot at redemption—one he frankly doesn’t even need.

DO BE EVIL

One unexpected (potential) redemption arc? Google.

The once-innocent startup that preached “Don’t be evil” before morphing into a Shadow Ministry of Truth.

Its redeeming gift? (Anti)trust.

Boxed in by its own business model—incumbency teetering on incompetency—Google left open a window of regulatory arbitrage wide enough for Perplexity to glide into search.

Perplexity’s arrival does more than let consumers upgrade to a (far superior) subscription search and opt out of the Surveillance Economy.

It also gives Musk the competition cloud cover to launch a Perplexity-style search offering that turns Google’s Ministry of Truth into a Museum of Search.

But there’s more: Waymo.

Expect Waymo’s march past Uber in SF rideshare to grease the wheels for SuperX’s initial Tesla “partnerships” or “promotions” without crossing an anti-competitive tripwire.

Civ VI, not checkers.

Embrace the Martian

Markets don't orbit around data – they spin on forward guidance.

Just as Jerome Powell’s whispers ripple through markets, pulling valuations along like links in a daisy chain, each pricing off the one before, Musk's words shape future expectations at cosmic scale.

And when Earth's largest companies are valued less on current earnings and more on promises of tomorrow, who better to guide us than our resident Martian?

Because when technology, politics, capital, and culture collide like particles in a hadron collider, only one person has built the machine to harness that energy, and his particle accelerator happens to be pointed at Mars.

Embrace your (inner) Martian,

Daniel

If you enjoyed this post or know someone who may find it useful, please share it and encourage them to subscribe here.

WHO IS THE RENAISSANCE CAPITALIST?

Part adventure capitalist, part librarian — Daniel Attia is a (venture) investor & builder who writes in the third person and backs founders reinventing reality through preemptive.

(portfolio below)

His lens comes from a random sprint through high finance, startups, tech & media, venture, hedge funds, and the arts.

He mastered capitalism's grammar at Deutsche Bank and Goldman Sachs before being force fed its real-life principles as the first US hire at Payapps (acquired by Autodesk for ~$500M).

Daniel would later shape tech and market perspectives as founding Head of Research at Prof G Media, contributing to works like the NYT Bestseller "Adrift: America in 100 Charts."

His favorite capitalist pastime may be steering companies away from entropy toward rationalism (often mislabeled as "shareholder activism"), partnering with hedge funds, families, and shareholders who've grown weary of watching their capital fund executive delusions.

Today, he serves on the Foundation Council at the State Library of Victoria—the world's third busiest library—while moonlighting as consigliere to founders and CEOs at pivotal crossroads.

Daniel also serves as Special Advisor to VP Capital, a HK based hedge fund.

Daniel co-founded Pew Pew NYC, a non-profit art collective for the creatively curious

(which just unveiled Call me Lola in Mexico City, the first live-in art gallery hotel experience where 70% of art sales flow directly to artists!)

Select venture investments:

beehiiv (this very platform) – Because Tyler Denk always had Big Desk Energy

SymphonyOS – beehiiv for artists (Business Insider Top 13 Creator Startups to Watch, just like beehiiv. Led seed alongside Tyler too)

Harmonic Discovery – Precision pharmacology (JP Morgan Life Sciences Award winner)

Carry – Putting tax optimization on autopilot, built by Ankur Nagpal who turned his $250M exit lessons at 32 into your tax solution

Measured – Medicine minus middlemen led by dreamer and DREAMer immigrant Monji Dolon (seed with Initialized Capital)

True3d — Building livestreaming infrastructure for 3D by Meta livestreaming veteran Daniel Habib (still can’t believe we got an investor mention alongside YC founder Paul Graham)

EatBlueprint by Jeff Tang (now merged with Bryan Johnson’s Blueprint)

Atelier – Making manufacturing magnificent again (Co-led Series A with Macquarie Capital, confirmed by the AFR paywall preview)