TL;DR: BEEHIIV IS GOING TO BE WORTH MORE THAN A BILLION, QUICKLY.

Inside this edition:

How beehiiv’s gone from VC cold shoulder to near unicorn in 3 years

Why Big Ass Problems™ matter more than Total Addressable Market

The real origin story from drunken empanada possibilities to one of the fastest growing media companies in the world

How tragedy transformed into legacy and beehiiv's unbreakable culture

Beyond Business (sentimental piece + week):

A raw look at moments that brought together the people behind the headlines, metrics, and companies (you might be mentioned, skip ahead)

Most up-to-date version with 90% less typos at renaissancecapitalist.beehiiv.com.

Tyler Denk

Sunday. 2 AM. May 2021.

Empanada Mama, Lower East Side.

I’m across from Tyler Denk.

Soon-to-be founder of beehiiv. The very platform this is posted on.

Back then, he was just the founder of Big Desk Energy, then only a public Spotify playlist that became a media company (different post).

Ironically enough, he's mid-bite into the classic “Viagra” empanada for most of this interaction.

He’s giving generous equity to cofounders who haven’t even shown up yet.

I restate that it's too generous.

He just shrugs.

“Daniel, these are the people who’ll help make this a billion-dollar company.

That pie’ll be so big, we won’t even remember this conversation.”

He’s made up his mind.

Most venture investors had too.

The prognosis? Email is dead.

Newsletter economy? Peaked (and also dead).

No investor wanted to back another newsletter platform.

Fast forward to 2024, and beehiiv is valued at a quarter of a billion dollars.

And I’d bet (again) it’ll break a billion-dollar valuation within a year.

Don’t want a tech history lesson?

Skip to next heading

Email has been around forever

TL;DR: Email has stuck around for decades because it’s the ultimate direct channel.

Email newsletters emerged from the primordial soup of pre-internet online communities (you read that correctly).

In the 80s, people (nerds) in search of a social network (other nerds) had to connect through a BBS (Bulletin Board System) PC program connected to a telephone line.

When the government finally unleashed the internet from its military-and-academic cage, AOL and other commercial internet service providers (ISPs) transformed bulletin boards into real-time connection.

Digital publications (boomer for newsletter) were born.

By the mid-‘90s, TidBITS – a newsletter and site focussed on Apple products – was reaching thousands of Mac enthusiasts (nerds) without a printing press, and Hotmail’s 1996 launch mainstreamed email as a personal broadcast channel.

Those once gimmicky toys would quickly evolve into the commercial infrastructure powering the digital economy.

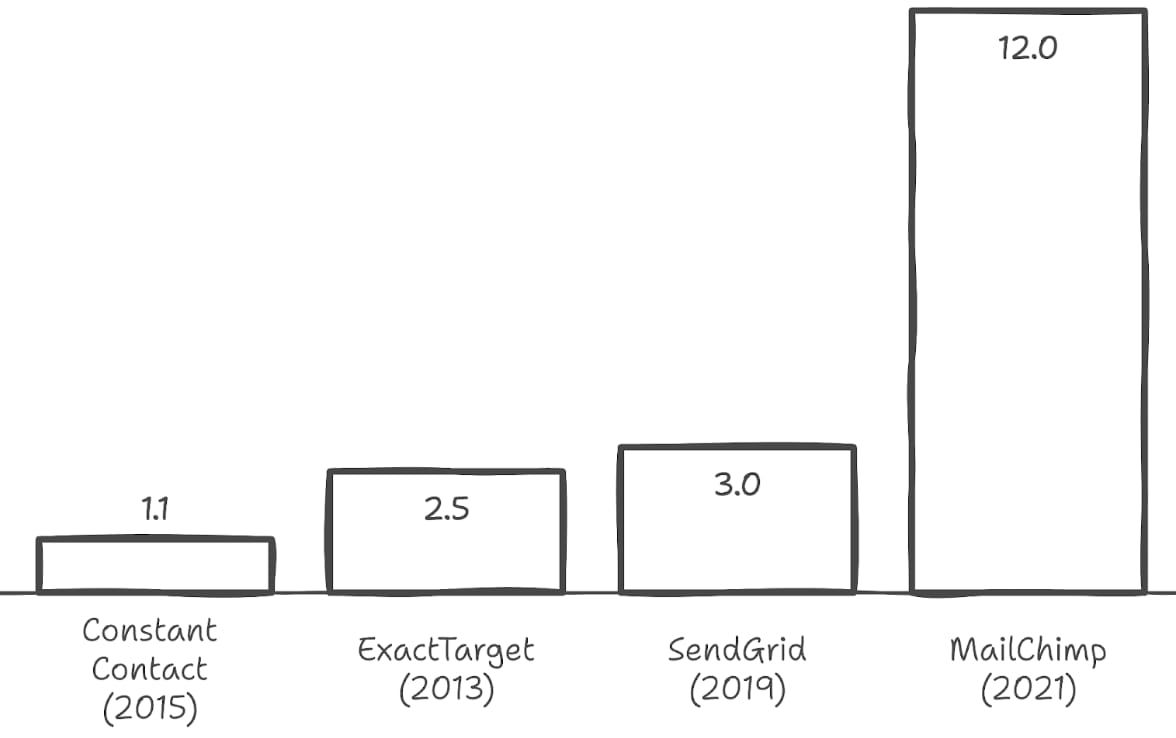

Platforms like Constant Contact (with a name as invasive as its product) helped small businesses wrangle subscriber lists (ie birth spamming). Mailchimp made DIY marketing campaigns actually doable. ExactTarget serviced clunkier corporates. SendGrid, meanwhile, quietly did the heavy lifting behind the scenes.

And as online attention shifted to texting, chatting, and posting all of those companies were acquired.

For billions.

Email economy acquisitions ($bn)

Email has been will be around forever

Over 4 billion people have and use an email address.

The problem?

Most platforms are stuck in dot com dashboards with a fresh coat of UI paint (with UI possibly even designed in Microsoft paint).

So yes, email newsletters have been around forever.

And that's exactly the opportunity.

The real problem? The industry had its growth stunted by a lack of vision.

Or more precisely, its vision was strangled into submission.

The OGs of email got acquired and shelved faster than contraband at a border checkpoint, relegated to SEC footnotes for giants like Salesforce and Intuit who saw email as a feature, not a future.

Enter Tyler.

Seeding a beehiiv

We've established that email is anything but dead (unless you're reading this with a sixth sense). But even being #2 employee and the tech mastermind behind Morning Brew's $75M exit—the newsletter that made newsletters cool again—didn't help Tyler's case.

Every VC conversation hit the same wall, usually via email (irony died that year):

"Email is dead."

"Newsletter economy's saturated."

"What's your moat against Substack?"

Each rejection landed with the predictability of a Mailchimp template.

It didn’t matter that Tyler had Google cred and was proposing to not scale another newsletter like Morning Brew, but scale the platform that would enable thousands of them. No one cared.

We’d have had better luck pitching a social network...

that was audio...

for dogwalkers.

(A Clubhouse for dogwalkers might’ve actually had a better shot of funding in 2021).

The newsletter graveyard was getting crowded:

Substack had just convinced a16z to park $65M at a $650M valuation

Meta's Bulletin flexed and flopped (now dead)

Twitter's Revue acquisition went from acquihire to retirement home (though its talent eventually found a better home at beehiiv)

Ghost’s decentralization hooked the crypto crowd (if you've never heard of it... exactly)

Investing in email was akin to necrophilia.

But Tyler had (other) believers.

Enter Maya Bakhai of Spice Capital (then at Kevin Durant’s Thirty Five Ventures).

While others saw a dead platform walking, Maya saw the future, almost immediately making beehiiv her fund's inaugural investment (killing it).

Then came the Morning Brew mafia: Josh Kaplan, Jenny Rothenberg, and Kinsey Grant who were now co-founders of Smooth Media (another post).

They all got it.

(Ironically, it took Morning Brew’s own founders a hot second to wake up and smell the coffee—they passed initially, anyway.)

Brian Hanly, an OG friend from NYC when I was moonlighting as a TV producer, not only got it but brought it to Howard Lindzon.

Howard is a(nother) renaissance capitalist – creative, comedian, hedge fund manager, and GOAT early-stage investor through Social Leverage.

He made time for me before I was worth the time (still aren't), sold his hit series WallStrip to CBS, birthed Stocktwits, and had a knack for spotting cultural shifts before they hit the zeitgeist.

Backing products at the coalface of culture served him well, with checks into Angelist, Robinhood, e-Toro and…

beehiiv.

Social Leverage's buy-in became the turning point, catalyzing what became a $2.6 million seed round from 30 strategic investors.

These (true) venture investors – including founders of companies I worked with like Scott Galloway and Geoff Tarrant – brought a mix of credibility, media assets, distribution channels, and industry credibility.

Any early product hiccups were offset by the sheer network effect of having the right people invested in beehiiv's success.

The same “venture” investor blindness that missed beehiiv at seed would make them miss what came next—and what's still coming.

Inaugural investor update, Sep 2021

Big Ass Problems™ > Total Addressable Market (TAM)

To Patagonia vest VCs, a big TAM hits like 20mg of Cialis in Saint Tropez. But most of the time, like the alleged VCs reading them, such TAMs are all tip, no iceberg.

Note: Maya and Howard are VCs in the classical sense, not the ZIRP-era-tard (lack of) sense.

Here's the thing about truly transformative companies: they don't just capture markets—they create entirely new ones.

That's where Big Ass Problems™ comes in, with vision and earned insights too powerful for any spreadsheet to predict.

Even the valuation king himself, Professor Damodaran, missed Uber’s potential by a country mile due to a valuation approach downstream of a fixed, static TAM.

He saw a taxi market; Uber was catalyzing a mobility revolution.

When creators are able to own their audience, data, and monetization pipelines, you’re no longer talking about a limited “newsletter economy.”

You’re talking about an entire digital transactional economy, for an entirely new group of users still hidden from the market.

This is part of the reason VCs were busy funding the 160th DTC mattress innovator, while missing a media evolution happening right under their AirPods.

(See above – “venture” investor blindness)

We’ve seen this film before.

Canva didn't just enter the design market—it created millions of new designers.

Duolingo didn't target existing language learners—it made everyone a potential polyglot (soy bilingue, btw)

In each of these cases, a Big Ass Problem™—not a tidy spreadsheet—revealed the true potential.

Tyler knew this at seed, saying:

“The best companies unlock and create new markets. We’re now seeing the democratization of creator tools, and beehiiv is a seamless on-ramp for creators to go direct-to-audience and generate meaningful revenue.”

But even Tyler underestimated it.

If you’re enjoying this post or know someone who may find it useful, please share it and encourage them to subscribe here or at https://renaissancecapitalist.beehiiv.com/

(INVESTING) SIDE BAR:

The BAP thesis crystallized during a late-night call with Yewy (another Goldman escapee turned CIO), outlining why I was leading Symphony's seed round – think beehiiv for artists, built by the minds behind your Spotify Wrapped list.

In Symphony, I saw the same patterns as beehiiv, and Yewy had seen the same with Canva (which he’d backed).

Also, the karma of cap tables: Years after we brought beehiiv to Maya, she returned the favor with Symphony. First at pre-seed when we were both as liquid as the Sahara, then bringing me in to lead their seed.

Tyler didn't just participate – he handed founders Megh & Chuka the playbook that's about to accelerate their vision post-Series A.

And the Tyler effect compounds.

When I led Measured's seed extension - a telemedicine revolution birthed by dreamer & DREAMer immigrant (& my former LES neighbor) Monji Dolon - Tyler worked his magic again.

Measured’s now adding seven-figure ARR this Jan (just like beehiiv) as they prep for Series A.

Millions of individuals and businesses would embrace email publishing with beehiiv’s simpler tools and clearer revenue potential. beehiiv isn't just lowering barriers—it's expanding the market beyond what any spreadsheet jockey could model.

The recent TikTok ban scare sent creators scrambling for their followers' emails, exposing the house-of-cards that is platform dependence.

It's why email remains the cockroach of distribution channels—unkillable and everywhere.

(DISTRIBUTION) SIDE BAR:

Remember when VCs, high on ZIRP-era hallucinogens, thought "Direct to Consumer" was a business model?

Well, not even Pfizer's finest could help those DTC-heavy, IQ-lite vintage funds perform.

Turns out they weren't funding a business model, just a VC-subsidized promise to optimize human potential with weighted blankets through DTC channels.

Yet, among DTC channels, email stands as its most resilient backbone.

Just as Uber expanded far beyond the legacy taxi market, beehiiv is reshaping the definition of email publishing—unlocking new audiences, new monetization paths, and verticals that didn't exist even in fever dreams a few years ago.

In other words, if you're still valuing beehiiv based on the historical 'newsletter' market, you're missing the point by a continental mile.

The Paint-by-Numbers Path to $1 billion

You take beehiiv’s current run rate, apply its historical growth—without even assuming it accelerates (spoiler alert: it is)—project it out 12 months, and end up around $50 million in ARR.

Next, slap the same valuation multiple from their Series B with NEA (shoutout Danielle Lay)—no extra credit for greater operational leverage, or any of the new products already launched or set to launch.

And boom: a billion-dollar valuation.

No mental gymnastics or community-adjusted EBITDA required.

Now, if we used Substack’s reported (read: ritzy af) multiple from its 2021 Series B—which initially pegged them at $650 million before a later down-round pegged everyone involved—beehiiv’s implied valuation would inch closer to $3 billion.

However that was 2021’s vintage blend of insanity, when venture investors were in a financial k-hole so deep the only thing keeping them tethered to reality was Blue Bottle by day, bottle service by night.

But more importantly, beehiiv isn’t Substack.

The creator economy's having its e-commerce moment. Just as Amazon once promised sellers instant access to millions of wallets, Substack dangles the same carrot to writers. But we've streamed this on Prime before.

Shopify flipped the script: instead of forcing brands to bow at Bezos's brand altar, they armed them with the tools to build their own brands. Now creators are having their Shopify moment—choosing sovereignty over convenience, ownership over dependence.

Enter beehiiv.

Building a real (media) business isn't just about squatting on borrowed audiences—it’s about having the foundation and ballast to set your own course. That means controlling the full stack: audience discovery, brand development, and engagement tools that weren’t built when Morgan Stanley still had a buy rating on Pets.com.

Like Shopify's approach to e-commerce, beehiiv provides the infrastructure while letting creators maintain full ownership of their brand and audience relationships.

beehiiv's vision also extends beyond just newsletters: a comprehensive platform that includes publishing, website building, monetization, and analytics—all while maintaining an open ecosystem.

If you prefer to host on your own domain, integrate with other platforms, and repurpose content across channels, beehiiv doesn’t punish you.

The Usual Suspects

Substack: Great for quick distribution and (initial) audience access, but with limited brand customization and data control options.

MailChimp: A pioneer that morphed into a bloated marketing suite, trading newsletter agility for enterprise bloat - expensive, overbuilt, and ironically underserving the creators who drove its initial success

beehiiv combines the best aspects of these platforms—Substack's simplicity, MailChimp's reliability—while eliminating their limitations.

The old guard?

Still manning trenches in wars that ended before Sean Parker suggested dropping the “the”.

WordPress: The website colossus that never quite figured out newsletters were more than just blogs with better delivery.

Medium: The former revolutionary now collecting dust in the media museum, right next to Clubhouse's "Once Valued at $4B" plaque (Substack's is already being engraved).

And speaking of (gold-plated) tombstones...

Meet ConvertKit: The gold standard of yesterday's yesteryear.

Founded in 2013, fossilized by 2024, it's facing its own Bitcoin moment.

Last week in our post Trump’s (Micro)Strategy, we described the flippening of gold by Bitcoin, which took a decade to grow from 0.14% to 14% of gold's market cap.

In just 3 years, beehiiv's already reached nearly half of ConvertKit's revenue.

beehiiv's flippening of legacy player ConvertKit happened at a more violent pace, and with the table manners of a meteor shower.

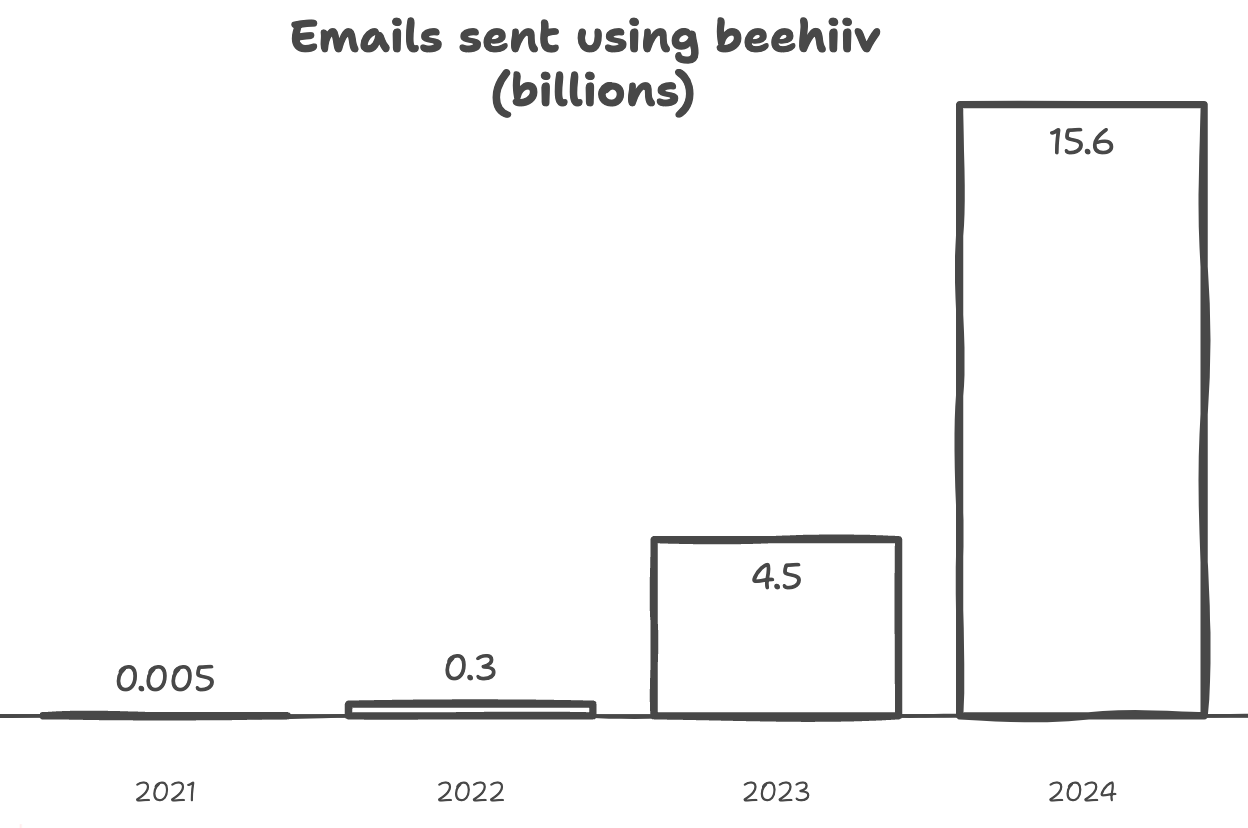

Every email sent (now in the billions) is another extinction-level event for this prehistoric platform more at home in a natural history museum.

Darwin would've called it natural selection.

beehiiv calls it a Tuesday.

Substack Full stack

Most startup pitch decks (especially at seed) are like astrology: vague enough to sound right to anyone, and about as grounded in reality as the explanatory power of Mercury in retrograde.

Said differently, they promise the stars but deliver horoscopes.

This is because most founders stand paralyzed at the entrance of what Balaji Srinivasan calls the "idea maze" - they haven't yet mapped the hidden doors, dead ends, and treasure rooms of their industry through direct experience.

Tyler, on the other hand, had the cheat codes. He was already speed-running the idea maze with the muscle memory of Morning Brew's playbook.

By the time beehiiv closed its pre-seed round, Tyler wasn't a star gazer. He was a maze runner.

Product Velocity

First came the table stakes, just at an F1 pace. beehiiv set ambitious timelines to at least match its (then) competitors feature-for-feature in a publishing platform race that would make Mario blush:

Tyler then raised the stakes: beehiiv would automate everything that made Morning Brew magical - from their viral referral engine to their monetization playbook - and package it into tools so simple that even your VC’s padel newsletter could use them.

No spreadsheet gymnastics.

No Stripe integration nightmares.

Just data that actually mattered, and money that made it matter.

Product comparison…. From November 2022

“The Formula”

Tyler didn't just flip from solving today's problems to building tomorrow's opportunities - he leapfrogged them. Like Jensen Huang betting NVIDIA's last millions on an oversized chip nobody thought they needed.

While futurists were celebrating the year irony died by writing newsletters about 'peak newsletter', beehiiv was quietly building the infrastructure for publishing's actual future.

Not just solving problems publishers didn't know they had - but creating the foundation for a world where everyone's a publisher, whether they planned to be or not – including this (highly) caffeinated analysis you're reading now.

The crazy part?

Tyler outlined that very vision

…in beehiiv’s seed deck.

When Tyler first suggested an ad network, I had to pause to remember the man's Big Desk Energy was a euphemism for having balls the size of small planets.

Hearing him talk about how newsletters were just the jumping off point – even in its (drunk) infancy – felt as close as I’d get to watching Bezos in '94 explaining how books were just the beginning.

Tyler wasn’t f**cking around, only resolute on finding out.

Most people laughed. Some called it delusional – and still do.

But Tyler had something most founders don't: a precise formula from the seed deck that read more like a prophecy than a pitch.

The genius?

Focusing on assembling a flywheel that, together, solved Big Ass ProblemsTM.

Better functionality attracted more publishers. More publishers attracted more audiences. Bigger audiences attracted more advertisers. And more monetization attracted more publishers.

And the flywheel (has) kept spinning. Faster.

Instead of chasing the same saturated markets, beehiiv swarmed towards the long tail of niche creators everyone else had ignored (see above: Big Ass ProblemTM).

A classic case of Clayton Christensen’s integrated steel mills vs. mini mills theory of disruption (a word I'd normally eat glass than use, but nom nom nom).

Today, that "crazy" ad network processes $9m in annualized payouts to publishers.

The website builder (post-TypeDream acquisition) has launched.

That Netflix content discovery system? Still on its way.

The upside? Netflix is part of the ad network.

Just like Bezos saw books as his Trojan horse into retail domination, Tyler viewed newsletters as his entry point into something much bigger: the infrastructure layer for modern media companies.

Meanwhile, boards of the Midget Mainstream Media™ congregate over high tea at The Ritz Carlton for their fifteen-hundredth emergency meeting about why Gen Z won't pay $29/month for GPT-regurgitated AP wire stories, praying their 15th new subscription product will save journalism.

Said differently, beehiiv builds, while others build excuses.

And unlike most founders who treat their product roadmap like a state secret, Tyler mapped out every twist and turn in public.

The Squareroot of Grass RootsTM

While other thoughtboi founders were busy crafting Hallmark-worthy "My Startup Journey 🧵" threads, Tyler and team transformed X into their real-time product laboratory.

The standard work week often became a product development sprint on steroids that would make even Arnold Schwarzenegger nervous (Arnie also has a Pump Club on beehiiv).

Feature previews dropped Mondays, user feedback flooded in Tuesdays, updates shipped Wednesdays, results shared Thursdays, and by Friday they'd be prepping to do it all again.

Rinse, repeat, scale.

beehiiv shrank the gap between user requests and live features—sometimes in as little as 72 hours.

In what I think of as the Squareroot of Grass RootsTM, every tweet became a focus group, every reply a feature request, every DM a chance to convert users into evangelists.

(Shoutout Bella, Dan Berk & EJ).

While legacy media players were busy trading content libraries like Pokemon cards (and subsidizing David Solomon's DJ career in the process), beehiiv executed M&A with surgical precision: each acquisition filling a specific gap in beehiiv's ecosystem.

Swapstack Acquisition: Turned the "how do I monetize?" question from a months-long headache into a one-click solution

TypeDream Integration: Because your newsletter deserves better than looking like a WordPress template from 2007

The result? A platform that doesn't just help you write newsletters – it builds media empires.

By December 2024, the results spoke louder than any pitch deck:

10,000+ Active Newsletters (2x growth in 12 months)

$15 million in ARR (hitting $16 million by January)

$9 million in annualized publisher payouts

This wasn't just a newsletter platform anymore – it was a media empire factory.

I summarize it in this video below (don’t subscribe).

When Loss Becomes Legacy

In the midst of beehiiv's earliest momentum, an unthinkable loss almost stopped everything cold: the sudden passing of founder & CTO, Andrew Platkin.

Tyler had reconnected with Andrew, his former mentee, in 2021 – the year beehiiv was formed.

Andrew's rare blend of kindness, technical brilliance, and builder's instinct made him the obvious first call when Tyler started plotting his next venture.

Andrew was the quintessential quiet force—brilliant, relentlessly helpful, and beehiiv's secret weapon for scaling.

One Friday morning, his last Slack message read simply:

"Not feeling well, going to lie down."

By the next day, he was gone, far too soon.

One less dreamer in a world starving for dreams.

It was the kind of loss that stops every breath, that sinks every heart, that silently seeps through the very soul of a company Andrew built from nothing but a shared belief.

The all-hands call that Monday opened to one painfully empty Zoom square.

But grief didn’t fracture the team Andrew left behind. It fused them.

An engineer mastered a new programming language in three days to fill Andrew's superhuman technical responsibilities.

Tyler, burying his own grief, kept every plate spinning—from investor calls to user support.

The entire team doubled down, turning shipping delays into tributes.

In the wake of this tragedy, Tyler made a decision that spoke volumes about not just him, but beehiiv's soul.

Tyler ensured Andrew's equity fully vested to his mother.

This wasn't just about ownership—it was about legacy.

As Tyler put it:

Knowing Andrew's mother holds a stake in beehiiv is a massive part of why we push so hard.

His legacy lives in this codebase, and we're determined to honor it.

With Andrew’s heartbeat echoing in the code, the team emerged with an unspoken truth: they'd walk through fire for each other—and for the vision Andrew helped architect.

Andrew’s memory on Tyler’s desk

No (Go)Daddy, No

By early 2024, beehiiv was on a tear that would’ve made Andrew proud.

Then GoDaddy took them off the map. Literally.

Let me set the scene: Tyler, 10 beers deep at a bachelor party in Cabo.

For context: this is a guy who doesn't do "days off". The man worked through Oktoberfest—a story for another time. But this was one of two times he actually tried to unplug.

Of course it was.

Then it hits: beehiiv newsletters start going dark.

Support channels light up like a Christmas tree.

Then hours tick by, the problem spreads onto X and Reddit posts, and Tyler—armed with nothing but drunk confidence—opens his inbox to find a GoDaddy email announcing they're killing beehiiv's DNS.

Translation for the non-technical: imagine running a restaurant when suddenly nobody can find your front door.

That's DNS death.

For beehiiv, it meant DOA.

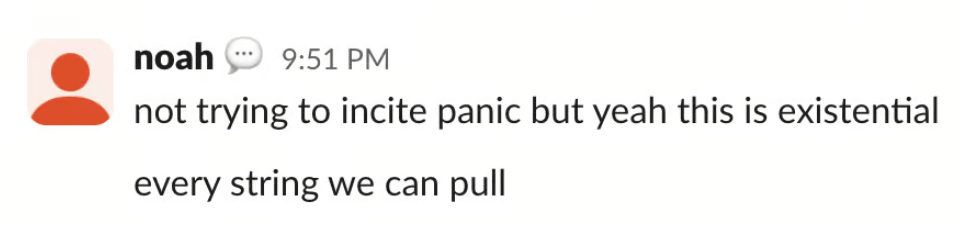

This infamous slack message from new CTO Noah Pryor summarized it best:

What followed was the quintessential startup war story.

Tyler, regretting the beer he lost count of, threw every Code Red signal he had into the digital void.

Around 1 AM, he finally got through to a GoDaddy support person who offered what might generously be called a lifeline—if your definition of lifeline includes a pool noodle in a tsunami.

The team pulled an all-nighter migrating their entire DNS infrastructure off GoDaddy.

Another crisis dodged, another war story added to the archives.

Moral of the story? Never take off work.

Or if you must, don't do it in Cabo.

Economies of scale

Every unicorn worth its alicorn ends up birthing entire ecosystems.

Uber didn't just disrupt taxis—it spawned fleet management empires.

Airbnb created more cleaning companies than a germaphobe's fever dream.

And Facebook turned "social media expert" from a punchline into a profession, spawning not single agencies, but an industry of them.

beehiiv's doing something similar, and hopefully with more appropriately placed oxford commas.

First came the newsletter dealmakers.

While VCs were ignoring “newsletters” and busy throwing money at any company with a dot ai domain and Stripe on its team page, a new breed of micro-PE emerged: newsletter flippers.

The play?

Take an undervalued newsletter (or undercovered emerging/niche concept), plug it into beehiiv's growth engine, grow the audience while monetizing it through the ad network, and wait around until a company desperate for distribution comes knocking on your door.

One example?

Milk Road, by legendary Shaan Puri of the My First Million Podcast.

The Milk Road grew to 250k readers and a reported 8-figure exit.

Despite hosting a show about best ways to make millions, he says his newsletter was the fastest way he's ever made money.

Newsletters are just the gateway drug - beehiiv's spawning its own service economy of growth hackers, enterprise newsletter agencies, and website builders faster than you can say "social media expert”.

If that sounds reminiscent of Shopify, welcome to the resistance.

Like Shopify arming D2C rebels against Amazon's empire, beehiiv's giving publishers of every size the tools to build their own, wherever they are.

Even local news and communities are having successful CPR with beehiiv.

My favorite?

Catskill News, which counts 10k subs and >$100k in revenue by sharing the latest events in the upstate NY town.

(There’s even a “Local News Industry Pulse” beehiiv to share trends and insights to other local publications to learn from).

Yet beehiiv is still in the first inning…

My only regret?

Not being born rich to have led the seed round myself.

At least (some) LPs are getting it now.

Staying in touch

My sleep schedule this week would turn Bryan Johnson’s face from translucent to literal window pane. In this fog, it can be hard to notice the small moments that give life its texture and meaning.

Luckily, that’s what friends like Tyler are for.

After making a 2am phone call to one such person today (sorry, Bryan), that friend sparked a lesson: to make sure to let people know you care about them.

That you appreciate them.

This morning, I stepped outside my Buenos Aires loft for a double-double espresso (see above: Casper), feeling borderline bluesy—until I heard a burst of contagious laughter.

One I could hear, but not yet see.

Seconds later, sunlight caught the neon vests of two garbage collectors laughing together in a street bin they had to climb into.

It gave me pause.

What else was I not seeing?

What else had I failed to notice or appreciate, silently or otherwise?

It shouldn’t take tragedies like Andrew Platkin’s to remind us to pause and let people know how much we value them.

People involved or mentioned in this post have recently lost loved ones: one lost a father, another lost a childhood friend in that tragic plane-helicopter collision in D.C. Sixty-seven lives were cut short—parents mourning children, children mourning parents—and thousands more in their interconnected networks now share a sudden, gaping hole in their lives.

This trip down memory lane made me reflect on how once-random ties now enrich my life every day—threads woven into a tapestry of connected people and communities.

In places like New York, when you connect with one node in the network, the rest lights up—and your entire world becomes brighter.

And that light brightens up more than just our world. This made me reminisce on many unlikely ties:

My connection with Howard through Brian Hanly of Bullish Media at the onset of COVID helping me see I could carve a very unique path without precedent

Maya’s evolution from ignored talent to investing in the best talent, all while helping us in every personal venture in our lives with a spice of life rarer than saffron

When Josh Kaplan tried to poach me to host a Pivot-like podcast on Morning Brew with the talented Alexis Gaye (who’s amazing, follow her) before deciding we’d start Prof G Media

Jenny Rothenberg at Smooth creating a template for this post, a welcome email, and so much other counsel I’m sure my ADD passed on – all unprompted

Being around for Tyler’s evolution from founder of unfundable company to pioneering new rails for his industry

Helping my neighbor Monji try scrap together checks, taking calls from Kaplan’s dad’s house and tapping into his incredible negotiation wisdom, with Ben Fisher of RPS Ventures coming in with the backup like the day 1 brother he is

Begging Scott Galloway to invest in Monji and him writing a fat check just to back a DREAMer immigrant when no one else would, doing what Howard did for beehiiv to Monji’s Measured and catalyzing their incredible success today

Watching my friend Geetika Rudra, a polymath and author of a brilliant book on immigration “Here To Stay: Uncovering South Asian American History,” who is also fast becoming Zuck’s right hand in the metaverse (arm not included) who not only encouraged me to publish, but helped bring out the voice you’re reading here.

There’s so much more.

But for all these people, I am thankful. Dearly.

Sometimes all we need is good friends and belief.

So today, I hope you’ll join me in more than just pausing—send a text, make a call, and remind people how much you appreciate their (continued) existence, just as I value all of yours.

Stay in touch,

Daniel

P.S. Tyler still remembers the Empanada Mama convo, but beehiiv’s yet to grow its alicorn.

If you enjoyed this post or know someone who may find it useful, please share it and encourage them to subscribe here or at https://renaissancecapitalist.beehiiv.com/

WHO IS THE RENAISSANCE CAPITALIST?

Part adventure capitalist, part librarian — Daniel Attia is a (venture) investor & builder who writes in the third person and backs founders reinventing reality through preemptive.

(portfolio below)

His lens comes from a random sprint through high finance, startups, tech & media, venture, hedge funds, and the arts.

He mastered capitalism's grammar at Deutsche Bank and Goldman Sachs before being force fed its real-life principles as the first US hire at Payapps (acquired by Autodesk for ~$500M).

Daniel would later shape tech and market perspectives as founding Head of Research at Prof G Media, contributing to works like the NYT Bestseller "Adrift: America in 100 Charts."

His favorite capitalist pastime may be steering companies away from entropy toward rationalism (often mislabeled as "shareholder activism"), partnering with hedge funds, families, and shareholders who've grown weary of watching their capital fund executive delusions.

Today, he serves on the Foundation Council at the State Library of Victoria—the world's third busiest library—while moonlighting as consigliere to founders and CEOs at pivotal crossroads.

Daniel also serves as Special Advisor to VP Capital, a HK based hedge fund.

Daniel co-founded Pew Pew NYC, a non-profit art collective for the creatively curious

(which just unveiled Call me Lola in Mexico City, the first live-in art gallery hotel experience where 70% of art sales flow directly to artists!)

Select venture investments:

beehiiv (this very platform) – Because Tyler Denk always had Big Desk Energy

SymphonyOS – beehiiv for artists (Business Insider Top 13 Creator Startups to Watch, just like beehiiv. Led seed alongside Tyler too)

Harmonic Discovery – Precision pharmacology (JP Morgan Life Sciences Award winner)

Carry – Putting tax optimization on autopilot, built by Ankur Nagpal who turned his $250M exit lessons at 32 into your tax solution

Measured – Medicine minus middlemen led by dreamer and DREAMer immigrant Monji Dolon (seed with Initialized Capital)

True3d — Building livestreaming infrastructure for 3D by Meta livestreaming veteran Daniel Habib (still can’t believe we got an investor mention alongside YC founder Paul Graham)

EatBlueprint by Jeff Tang (now merged with Bryan Johnson’s Blueprint)

Atelier – Making manufacturing magnificent again (Co-led Series A with Macquarie Capital)