Inside this edition:

The Velvet Alcatraz of status games and why I refused a gilded cell

The power of “enough” and what Kurt Vonnegut knew about it

How your network is your net worth in ways spreadsheets can’t measure

Why the real cost of learning isn’t tuition, it’s scar tissue

It’s not about wealth, it’s about showing up when life calls your name

Most up-to-date version with 90% less typos at renaissancecapitalist.beehiiv.com.

I turned 33 on Monday.

My mother, the keeper of every family memory, reminded me that when I was 14, I told her I’d be retired by now.

And it turns out self reliance was less a phase, more early obsession.

Working at Burger King, I’d read Walden in the freezer during breaks — the only place I ever froze and dreamed at the same time.

Saturdays began with firing up the broilers at 4am, then a bus ride to Target for a 1 to 5pm shift, followed by another cross-town trip to work at a grocery store, Woolworths née Safeway.

I was clocking north of 40 hours a week while still in school. North of 60 if holidays (and suspensions) permitted.

All for six bucks an hour. Technically ~$5.72, but who was counting (besides me… obsessively).

I had other “hustles” during school hours, too.

I undercut the school canteen selling soft drinks out of repurposed lockers. Flipped early smartwatches a decade too early. Ordered and resold replica Jordans off Alibaba. I sold fireworks around festivities like New Year’s.

So when a Goldman Sachs MD once asked how I felt about regularly working more than 70-hour weeks in one air-conditioned office, I said throw in dinner and a ride home and I’d do 90.

(Not realizing that was already part of the “perks.”)

I was relentless.

But I wasn’t chasing pay as much as I was chasing peace.

Financial. Emotional. Existential.

It wasn’t that I didn’t want to work. I just didn’t want to worry. In fact, I’ve probably never worked harder.

Enough

At a billionaire’s party on Shelter Island, Kurt Vonnegut once told his friend Joseph Heller that their host had made more money that day than Heller had earned from Catch-22 over its entire lifetime.

Heller didn’t blink.

“Yes,” he said, “but I have something he will never have — enough.”

I try to live by that.

But I’m also human — still running on 5-million-year-old firmware optimized for survival, not contentment.

Status envy isn’t a bug. It’s a feature. And it takes conscious effort to override it.

Still, I try.

Because maybe — by some definitions — I’m already retired.

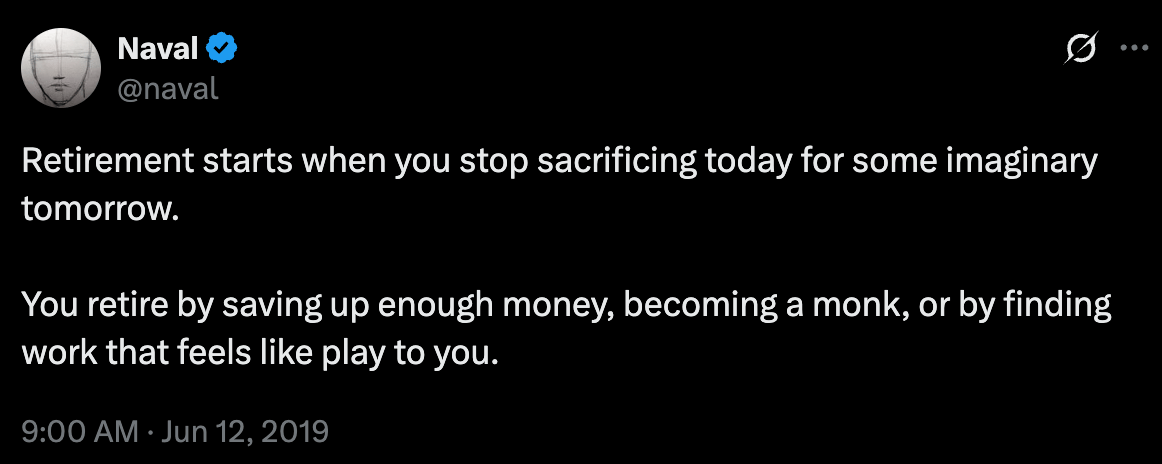

Naval Ravikant calls retirement the point at which you stop trading time for money.

It’s a concept echoed by philosophers across dialects, word counts, and mediums for millennia — from papyrus to print to the platforms we now playfully call social media.

Thoreau may have said it best:

“Wealth is the ability to fully experience life”

By that definition, I’m wealthy.

Could I have more? Sure.

Do I want more? Most do.

Would it change my life? Probably not.

I don’t care for flashy watches. A chipped Garmin serves me just fine.

I’m not interested in viewing the world through the optics of status — my own 20/20 vision is a blessing.

And the people I admire don’t need that stuff either.

Boca Raton Barthelona

I’m writing this from an apartment in Barcelona.

Though next week, I’ll be ringside at CoreFC in Istanbul for its mammoth debut on April 26 at Ülker Sports Arena.

Ata Bayraktar — Europe’s Dana White, if you believe the whispers — texted this morning to let me know he’s booked me a room at the same hotel as the headline fighters.

I assume this is either an honor or a subtle threat.

Hard to tell with good great friends.

I spend my days doing what I love: researching, investing, supporting founders who are building companies that matter.

I wake up at 6am, make hours of headway before a founder pings me — either about the fire we’re about to put out or the arson we’re about to inflict on incumbents.

By the time Trump’s latest misunderstanding of global trade sparks another Orange Swan event, I’ve already logged a full day.

I run a venture fund with a few trusted LPs I care for deeply — people who’ve entrusted me with nearly all of their venture allocations, despite having access to “the best” funds.

Maybe one reason is that we’ve kept things small, by design — even though we could’ve scaled into the same institutional capital pools those funds now chase for ever-expanding rents.

I could’ve gone the other route: built a team, raised a larger fund, played the same game.

But I’ve chosen to play long-term games, and only with long-term people.

See above — “enough”.

Sidebar:

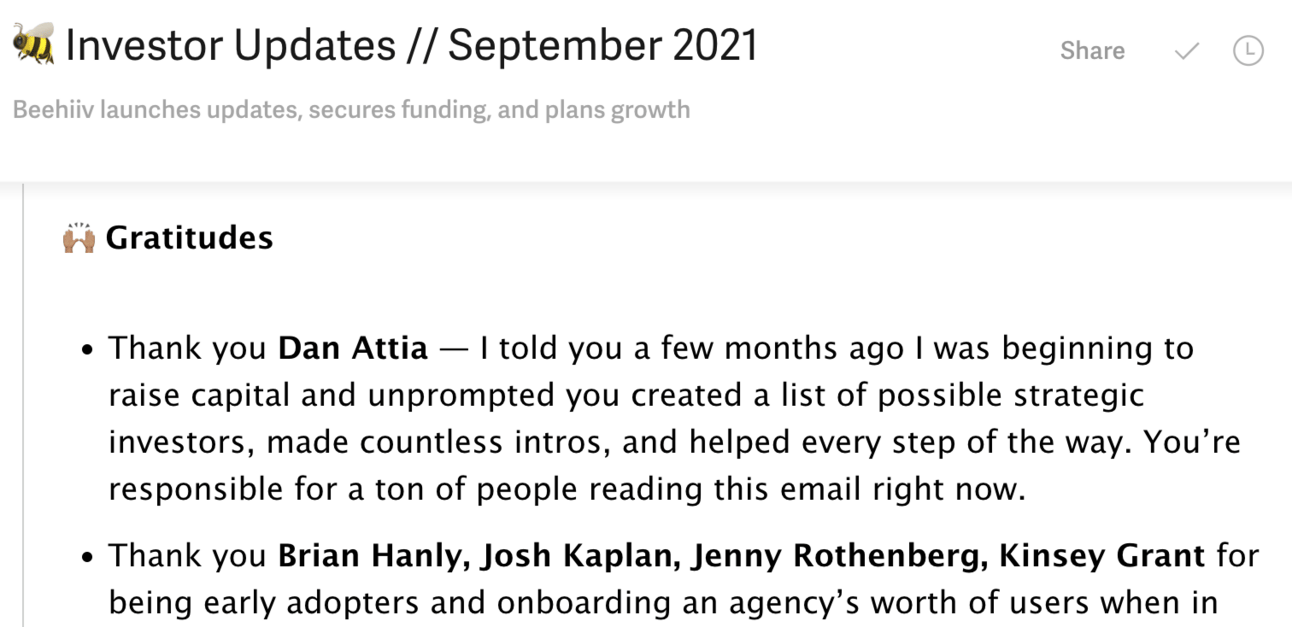

I’ve been pitched funds much larger than ours, citing beehiiv and Payapps as flagship deals.

Being early in both, and having helped shake the trees to help get them funded, I was curious how they were involved.

I still speak with those founders almost daily — about life, their businesses, and the fund’s portfolio cos (which they’re invested in) — so I asked.

None could place the names. I squint a little harder at decks now.

beehiiv’s inaugural investor update

If you enjoy this post or know someone who may find it useful, please share it and encourage them to subscribe here or at https://renaissancecapitalist.beehiiv.com/

Scar Tissue

There was a path where I might’ve had 10x the wealth I do now. But I kept buying (real life) MBAs.

Not the Wharton kind. The kind of MBAs you pay for in bruises and broken theses.

The Payapps seed round was my first (real) MBA. Among many lessons (a euphemism for mistakes): I sold secondary too early, then rolled the proceeds into a string of new MBAs.

Some were wins.

Some were very expensive seminars.

(That’s angel investing for “SAFE Terminations and Release Agreements”).

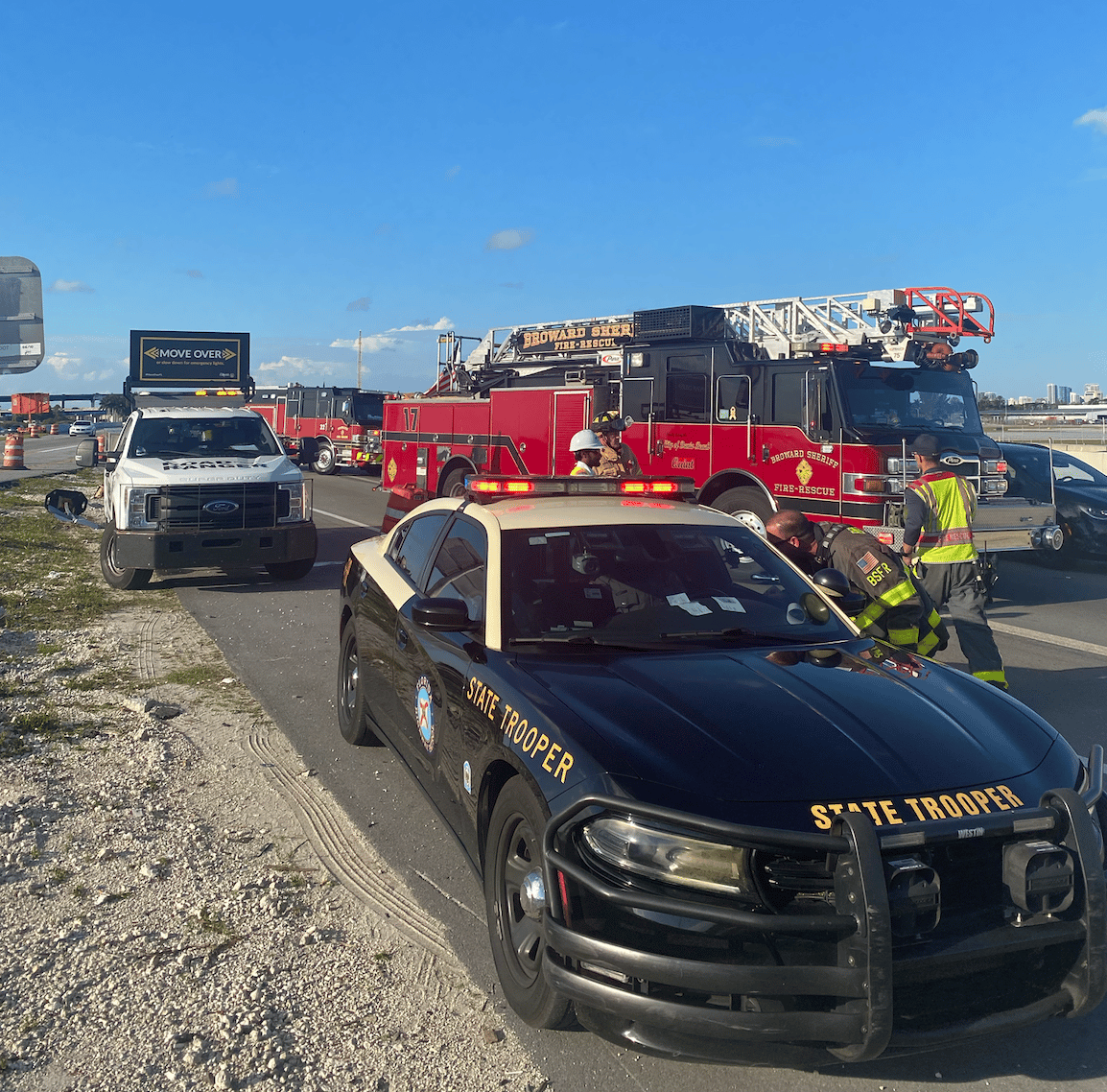

There were accidents, and mistakes followed.

After leaving Scott Galloway’s house for a CNN shoot, I hopped in an Uber to head to the Pivot Conference.

On the way, my spine got a makeover — courtesy of a missile wrapped in aluminum on rubber wheels.

The crash shut down the I-95 and left my discs stacked like a drunk patsy’s poker chips.

The I95 viewed from the ambulance

I was spread too thin, but still dead-set on making sure Prof G Media became the most insightful outlet in business and tech as founding head of research.

(It now has two of the top five pods in the category.)

But in my personal investing, it wasn’t hubris that got me.

The problem wasn’t overconfidence, it was overextensionhyperextension.

There were positions I should have exited. Signals I registered but couldn’t act on.

Pain does strange things to your risk management. I became too sleepless, too exhausted, and perhaps too broken to care.

And somewhere in that fog, the kind of upside that would’ve made my 14-year-old self believe I’d made it was napalmed away by pain and apathy.

(Mind you, I got everyone else in my orbit to act on it. I just couldn’t bother doing it myself.)

But I learned. Recovered. Kept going. As my mentor and LP Geoff Tarrant often reminds me:

You can only move forward

Luckily, I’m not alone.

Long before the investors I admire most managed billions, they blew thousands. Repeatedly.

Their funds now feed the returns for teachers, pensioners, and sovereign nations.

The lesson?

Sometimes the real cost of learning isn’t tuition — it’s scar tissue.

Net Worth Network

My individual portfolio exists for one reason: To fund the performance of the fund.

I’ve effectively gone all in. Levered to the upside — just as I was with Payapps in the early days.

But managing that kind of exposure takes a different kind of investment: One others make in you.

Enter Howard Lindzon.

Founder of StockTwits, reformed hedge funder, and prolific early-stage investor behind Robinhood, eToro, and many others.

We met years ago on a random Zoom — long before he led beehiiv’s seed round in 2021.

Since then, he’s been a mentor market rabbi and advocate for my research, scribbles, and the way I think about investing and markets.

He shared my early posts on why X would merge with xAI to form the spine of ‘SuperX’ (so far, so good), and why beehiiv would be my next unicorn.

That encouragement led to my piece on CoreWeave’s Initial Final Public Offering — AKA The Magnetar Trade 2.0 — which few others seemed to be capturing.

…. Until I flooded editors at places like the FT with findings from the S-1 that read like a structured-to fail-product dressed in AI drag — as they say, ‘when the ducks quack, crossdress them’.

Sidebar:

You can now listen to the above posts in Tyler Denk’s voice on beehiiv at these links:

The Magnetar Trade: CoreWeave (AI) Edition

An IPO Priced to Perfection, Built for Collapse, and Rigged to Detonate on Retail

Why beehiiv will be (more than) a billion dollar company (quickly)

How Elon Flips the Bird into Earth's Most Valuable Company

TikTok Sold Separately

You can also now listen & subscribe on Spotify here.

He loved the CoreWeave post’s analysis, shared it, and brought me onto his StockTwits livestream to talk about it (later posted to Youtube here).

In the conversations that followed, his lens helped me think about allocation without becoming a trader.

It wasn’t just the podcast — it was the timing. We stayed in close contact on markets that happened to align with the economic seppuku ironically dubbed “Liberation Day.”

He tempered my instincts, sharpened my theses, and gave me conviction when I needed it most.

That’s how I was able to invest — heavily, and hopefully intelligently — when Trump declared Adam Smith’s Wealth of Nations fake news and gave us Orangutan Monday.

Sometimes you don’t need a signal. You just need someone who’s seen this movie before.

Another steady hand has been Tom Lambeth — the best hedge fund manager you’ve never heard of.

VP Capital, the fund he cofounded with John So Jr, has quietly outperformed since inception.

But the real edge is the access: SPVs with ~30x returns, and dividend-paying growth companies (not a typo) yielding me close to 20% while still compounding top-line at triple digits.

That runway helps me build the fund the way he once did — on little more than loyalty, reciprocity, and the fumes of distant performance fees.

The point?

Life is long.

Relationships compound.

And if you’re lucky, they compound better than your portfolio.

That’s why your network is your net worth in ways no spreadsheet can measure.

(If you’re looking for quiet exposure to hedge funds riding Asia’s next wave — especially out of Hong Kong — happy to intro)

Velvet Alcatraz

Country clubs aren’t my thing (shocker, I know), nor are accumulation contests or status games.

It’s less a lifestyle than a minimum-security prison — a velvet Alcatraz of status games for the upwardly mobile.

Just when you think you’ve tunneled your way out, you realize you’ve simply been transferred to a more gilded cell block.

(If that sounds like escaping Goldman Sachs for KKR, you’re getting the picture — in painfully high definition.)

Within that velvet Alcatraz, you start competing for prizes no one actually wants.

For prizes that are as hollow as the contemplations that drew people to chase them in the first place.

And worse: they’re reflexive.

The fact that others want the prize is what makes you want it.

Which makes it more expensive.

Which makes more people want it.

Soros explained the mechanism. Girard explained the motive.

Just add a Rolex and a lease, and congrats – you’re broke and admired.

Welcome to reflexive status loops.

Desire becomes the product. Price becomes the proof. And no one remembers what they actually wanted.

Civ VI, Not Checkers

The more powerful move seems to be to love what you have rather than chase what others want (or what others want you to want) under the consensual hallucination that it’s your own desire.

I’m more compelled by Aristotle’s eudaimonia.

In Nicomachean Ethics, he describes it as:

“the activity of the soul in accordance with excellence”

Less about winning, more about becoming.

Fulfilling one’s potential through courageous, deliberate action — not swinging at hollow piñatas with a blindfold on just to please the crowd.

I’m here to stretch myself — to test my intellect, courage, convictions, and creativity.

As Joe Lonsdale once quipped (hey Joe!):

“If you can play chess, you don’t want to play checkers.”

We only want to play long-term games — the kind where the rules are more complex, the outcomes more emergent, the impact compounds, and the directional arrows point toward progress.

Civ VI, not checkers.

Preparedness > Independence

It’s not really about financial independence.

And it’s not even just about potential, or the thrill of earning secrets that will move markets.

(Like the ones behind True3D (patents pending) and Atelier, which helped a major CPG giant onshore entire supply chains in weeks to avoid tariffs while their peers consider pulling guidance).

It’s about being reliable.

To the people who need you.

To the causes that shaped you.

And to the version of you that didn’t have much — but promised to be ready when the moment came.

To take care of your mother when the world turns sideways.

To fund things that don’t need to make money, but matter.

To live below your means, so you can exceed them when it counts.

That’s what preparedness looks like.

I sit on the Foundation Council of the State Library because it’s one of the last true third places — a space where anyone can walk in off the street and change their life.

A secular church for upward mobility. A blueprint for what publicly funded institutions ought to be.

Last year, it became the third busiest library in the world — and was named the third best.

And maybe one day, I’ll be able to help fund its next grand pursuit, because learning shouldn’t require luck.

And dreaming shouldn’t require debt.

Sometimes, markets don’t move — they mood swing, inflicting the maximum pain on the maximum number of participants in their wake.

And life’s no different — it opens fast, it closes faster, and it rarely sends notice.

Said differently, I don’t want to be rich.

I want to be ready.

As for now, time for chess.

Brazilian Jiu Jitsu, not Civ VI.

To your (true) wealth,

Daniel

PS — I’ve been genuinely floored by how many like-minded investors — from LPs to founders — have shown up in my inbox through writing like this.

We’re not raising right now. But if you’ve read this far, odds are we’re already playing long-term games.

I’ll be sharing select co-invests soon — a way to say thanks, and a chance to build with those who’ve found resonance here.

If you enjoyed this post or know someone who may find it useful, please share it and encourage them to subscribe here or at https://renaissancecapitalist.beehiiv.com/

WHO IS THE RENAISSANCE CAPITALIST?

Part adventure capitalist, part librarian — Daniel Attia is a (venture) investor & builder who writes in the third person and backs founders reinventing reality through preemptive.

(portfolio below)

His lens comes from a random sprint through high finance, startups, tech & media, venture, hedge funds, and the arts.

He mastered capitalism's grammar at Deutsche Bank and Goldman Sachs before being force fed its real-life principles as the first US hire at Payapps (acquired by Autodesk for ~$500M).

Daniel would later shape tech and market perspectives as founding Head of Research at Prof G Media, contributing to works like the NYT Bestseller "Adrift: America in 100 Charts."

His favorite capitalist pastime may be steering companies away from entropy toward rationalism (often mislabeled as "shareholder activism"), partnering with hedge funds, families, and shareholders who've grown weary of watching their capital fund executive delusions.

Today, he serves on the Foundation Council at the State Library of Victoria—the world's third busiest library—while moonlighting as consigliere to founders and CEOs at pivotal crossroads.

Daniel also serves as Special Advisor to VP Capital, a HK based hedge fund.

Daniel co-founded Pew Pew NYC, a non-profit art collective for the creatively curious

(which just unveiled Call me Lola in Mexico City, the first live-in art gallery hotel experience where 70% of art sales flow directly to artists!)

Select venture investments:

beehiiv (this very platform) – Because Tyler Denk always had Big Desk Energy

SymphonyOS – beehiiv for artists (Business Insider Top 13 Creator Startups to Watch, just like beehiiv. Led seed alongside Tyler too)

Harmonic Discovery – Precision pharmacology (JP Morgan Life Sciences Award winner)

Carry – Putting tax optimization on autopilot, built by Ankur Nagpal who turned his $250M exit lessons at 32 into your tax solution

Measured – Medicine minus middlemen led by dreamer and DREAMer immigrant Monji Dolon (seed with Initialized Capital)

True3d — Building livestreaming infrastructure for 3D by Meta livestreaming veteran Daniel Habib (still can’t believe we got an investor mention alongside YC founder Paul Graham)

EatBlueprint by Jeff Tang (now merged with Bryan Johnson’s Blueprint)

Atelier – Making manufacturing magnificent again (Co-led Series A with Macquarie Capital)